A semester of classroom study was put to the test on December 12, as students in The Peter J. Tobin College of Business at St. John’s University delivered recommendations for three University endowment funds.

Six teams of students presented recommendations for cryptocurrency transactions as part of the University’s Student-Managed Blockchain Fund (SMBF). They were followed by four teams of students who pitched ideas for the public equities-focused undergraduate Student-Managed Investment Fund (SMIF), and another four teams who pitched for the graduate SMIF.

The end-of-semester presentations were the climax for students enrolled in the undergraduate courses Crypto Trading and Trading Strategies and Managing Investment Funds that are offered as part of the Bachelor of Science in Finance degree program, as well as the graduate course Quantitative Asset Management, part of the Master of Science in Finance and Master of Business Administration programs.

The pitches took place at the University’s Manhattan, NY, campus before a committee of faculty, administrators, and alumni, who reviewed the presentations and voted on whether to advance the transactions. All presentations included comprehensive student-created reports on the stocks or cryptocurrencies.

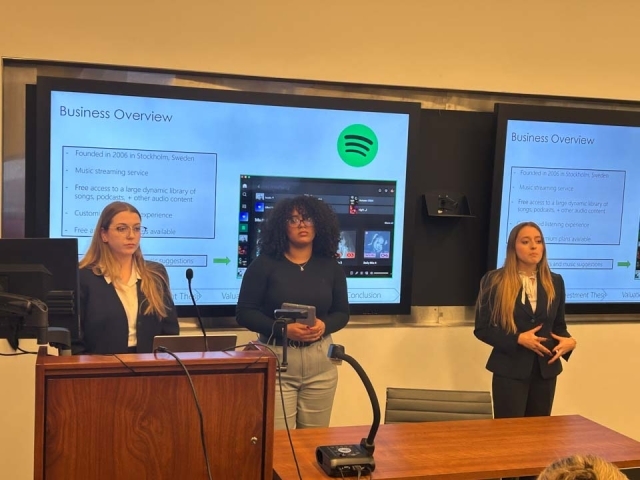

“Being able to analyze companies and do qualitative and quantitative research was very interesting,” senior Finance major Brianna Garrison said. “It was our first attempt at doing an equity report for all of us, and we all learned so much. It was very rewarding.”

Brianna joined classmates Karina Bono and Katrina Heckman in recommending buys in two large telecommunications stocks—Spotify and Verizon—who they believe are primed for expansion. Katrina, a Management major, said the exercise gave her a better sense of how to properly value companies, which could pay dividends later.

“As you do these valuations, you can find that the true value of a company might not be what the market perceives it to be,” Katrina said. “That can be important if you want to build your portfolio or manage one you already have.”

Started in 2001, the undergraduate SMIF is presently valued at $7.04 million while the graduate fund, launched a year later, is valued at $4.7 million. Both funds, tied to long-term stock investments, have generated 9 percent to 10 percent annualized returns since inception.

Approved in May 2022, the SMBF complements the undergraduate SMIF, in which students research cryptocurrencies and present investment recommendations. The students managing the SMBF vote on their peers’ purchase and sale recommendations with oversight from faculty and the University’s Investment Office. The market value of the SMBF has nearly tripled since its inception.

The funds are among several experiential-learning opportunities available to St. John’s students. The Tobin-based Executive-in-Residence Program enables students to engage in real-world business consulting. Other initiatives include the Venture & Innovation Center dedicated to product inspiration, and the Global Loan Opportunities for Budding Entrepreneurs (GLOBE) student-managed lending program. The University sponsors other business-development initiatives open to students, such as the annual James and Eileen Christmas Business Plan Competition and Pitch Event and the ideation competition Johnny’s Innovation Challenge.

That commitment to experiential learning separates St. John’s from other institutions, said investment committee member Jonathan Byrne ’16TCB, ’18MBA, Vice President, Investment Strategy and Sector Research at Manhattan, NY-based Strategas Research Partners. Mr. Byrne participated in the graduate SMIF program while pursuing his M.B.A.

“These are the types of classes that build a student skill set,” Mr. Byrne said. “The classes associated with the SMIF were some of the most thought-provoking classes I have ever taken. It gave me tangible experience in what I wanted to do, which was to work in markets.”

The St. John’s blockchain portfolio was initially funded with $100,000 and has grown to $285,000. In March of 2024, the price of Bitcoin, the leading cryptocurrency, passed $73,000 – an all-time high that signaled a resurgence from a period of volatility that tested the currency's integrity and resilience.

“It has been true that when Bitcoin shoots up, everything else follows,” said Finance major Marc Melone, part of a three-person team that advocated for an increased stake in the world’s largest cryptocurrency. “It’s a leader among coins and its community is always going to grow.”

Once considered a renegade technology, cryptocurrency has been gaining mainstream favor in recent years. It is based on blockchain technology, which records transactions in code, holding the information together via cryptography. Cryptocurrency can circulate securely without monitoring from a central authority such as a government or bank.

All six crypto teams advocated for greater investment in the currencies. Some noted that cryptocurrencies benefit from a rollback of interest-rate increases from the Federal Reserve.

“Volatility is at the heart of the crypto market,” said Zenu Sharma, Ph.D., Assistant Professor of Finance, adviser to the cryptocurrency fund, and Crypto Assets and Trading Strategies instructor. “But this year, especially after the presidential election, students seem more bullish than in the past.”

However, Dr. Sharma said the ability to look beyond Bitcoin and discover other potential investments is one of the lessons students learn in the Crypto Assets and Trading Strategies course. Student teams recommended increased stakes in the currencies Avalanche, Chainlink, Polkadot, and Polygon, which were approved.

In advocating for Polygon, students Vincent Caterina, Nicholas Delaurentis, and Anthony Trupiano noted its low service fees and quick execution of transactions. They were also enthusiastic about its ability to grow its community of users and, as Anthony explained, “it has a tendency to gain in price at the start of new years.”

Related News

From Classroom to C-Suite: Tobin Graduate Students Deliver Real-World Insights to The New York Post

More than 20 graduate students from the Peter J. Tobin College of Business stepped into the boardroom at The New York Post on December 2 to present cutting-edge research on Gen Z media consumption...

St. John’s Junior Alexandra Cicala Secures New Funding to Advance Her Financial Literacy App, uFinLit

St. John’s University junior Alexandra Cicala ’27 has taken another major step in her mission to improve financial literacy among young people. The Business major on the Pre-Law track was recently...

Tobin Students Earn 2nd Place at the Alpha Seekers Invitational

Students from the Peter J. Tobin College of Business at St. John’s University made a standout showing at the Alpha Seekers Invitational, earning second place in the CFA-style equity research...